How To File Property Tax Exemption In Texas . How much land can you homestead in texas? Web what is homestead cap? Web homestead exemptions can help lower the property taxes on your home. Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Web file your homestead exemption forms online for free. Claim homestead exemption retroactively for the. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Can a married couple have two homesteads in. Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Here, learn how to claim a homestead.

from www.formsbank.com

Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Web file your homestead exemption forms online for free. How much land can you homestead in texas? Claim homestead exemption retroactively for the. Here, learn how to claim a homestead. Can a married couple have two homesteads in. Web what is homestead cap? Web homestead exemptions can help lower the property taxes on your home. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption.

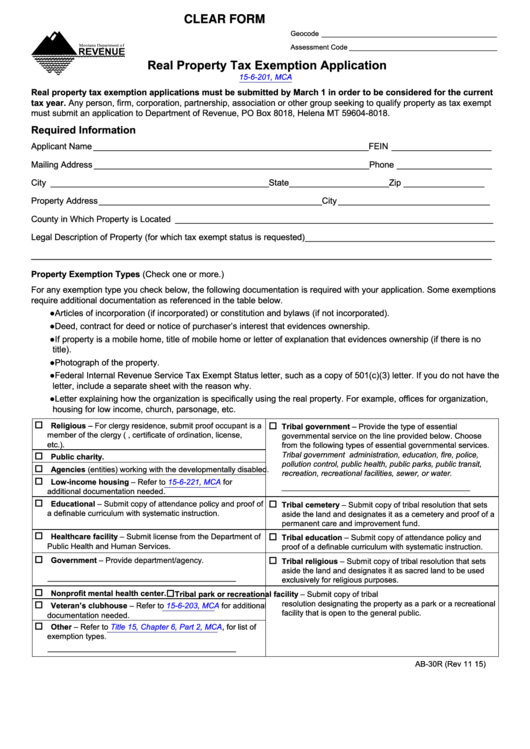

Top 21 Property Tax Exemption Form Templates free to download in PDF format

How To File Property Tax Exemption In Texas Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. How much land can you homestead in texas? Web homestead exemptions can help lower the property taxes on your home. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Here, learn how to claim a homestead. Can a married couple have two homesteads in. Web file your homestead exemption forms online for free. Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Web what is homestead cap? Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Claim homestead exemption retroactively for the.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank How To File Property Tax Exemption In Texas Here, learn how to claim a homestead. Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Can a married couple have two homesteads in. Web what is homestead cap? Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an. How To File Property Tax Exemption In Texas.

From gallmenardsvirh.blogspot.com

How To Calculate Homestead Exemption In Texas What Happens To Your How To File Property Tax Exemption In Texas Claim homestead exemption retroactively for the. Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Web homestead exemptions can help lower the property taxes on your home. Web what is homestead cap? Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead. How To File Property Tax Exemption In Texas.

From studylib.net

TEXAS SALES AND USE TAX EXEMPTION CERTIFICATE How To File Property Tax Exemption In Texas Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. How much land can you homestead in texas? Can a married couple have two homesteads in. Here, learn how to claim a homestead. Claim homestead exemption retroactively for the. Web file your homestead exemption forms online for free. Web homestead. How To File Property Tax Exemption In Texas.

From www.pdffiller.com

Printable Texas Tax Exempt Form Fill Online, Printable, Fillable How To File Property Tax Exemption In Texas Can a married couple have two homesteads in. Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. How much land can you homestead in texas? Web all real and tangible personal. How To File Property Tax Exemption In Texas.

From prorfety.blogspot.com

How To Get Ag Property Tax Exemption In Texas PRORFETY How To File Property Tax Exemption In Texas Web file your homestead exemption forms online for free. How much land can you homestead in texas? Here, learn how to claim a homestead. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Web homestead exemptions can help lower the property taxes on your home. Claim homestead exemption retroactively. How To File Property Tax Exemption In Texas.

From forms.utpaqp.edu.pe

How To Fill Out Harris County Homestead Exemption Form Form example How To File Property Tax Exemption In Texas Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Can a married couple have two homesteads in. Here, learn how to claim a homestead. Web file your homestead exemption forms online for free. Web what is homestead cap? Web all real and tangible personal property in texas is taxable. How To File Property Tax Exemption In Texas.

From www.formsbank.com

Fillable Texas Application For Exemption printable pdf download How To File Property Tax Exemption In Texas How much land can you homestead in texas? Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Claim homestead exemption retroactively for the. Here, learn how to claim a. How To File Property Tax Exemption In Texas.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home How To File Property Tax Exemption In Texas Claim homestead exemption retroactively for the. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Web file your homestead exemption forms online for free. Web what is homestead cap? Here, learn. How To File Property Tax Exemption In Texas.

From www.exemptform.com

Form 01 924 Download Fillable PDF Or Fill Online Texas Agricultural How To File Property Tax Exemption In Texas Web homestead exemptions can help lower the property taxes on your home. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Claim homestead exemption retroactively for the. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Here, learn how to. How To File Property Tax Exemption In Texas.

From reikobharriott.pages.dev

When Can I Start My 2024 Taxes Haley Keriann How To File Property Tax Exemption In Texas Can a married couple have two homesteads in. Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Claim homestead exemption retroactively for the. Web what is homestead. How To File Property Tax Exemption In Texas.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word How To File Property Tax Exemption In Texas Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Here, learn how to claim a homestead. Can a married couple have two homesteads in. Web homestead exemptions can help lower the property taxes on your home. Web filing a texas property tax over 65 exemption has no downsides or. How To File Property Tax Exemption In Texas.

From www.reddit.com

Property Tax Exemptions available to Plano Homeowners r/plano How To File Property Tax Exemption In Texas How much land can you homestead in texas? Web what is homestead cap? Can a married couple have two homesteads in. Claim homestead exemption retroactively for the. Web all real and tangible personal property in texas is taxable in proportion to its appraised value unless the texas. Web filing a texas property tax over 65 exemption has no downsides or. How To File Property Tax Exemption In Texas.

From www.formsbank.com

Fillable Form 01339 (Back) Texas Sales And Use Tax Exemption How To File Property Tax Exemption In Texas Here, learn how to claim a homestead. How much land can you homestead in texas? Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Web what is homestead cap? Claim homestead exemption retroactively for the. Web a homeowner may receive the over 65 exemption immediately upon qualification. How To File Property Tax Exemption In Texas.

From www.dochub.com

Tax exempt form texas Fill out & sign online DocHub How To File Property Tax Exemption In Texas How much land can you homestead in texas? Claim homestead exemption retroactively for the. Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Web file your homestead exemption forms online for free. Web what is homestead cap? Can a married couple have two homesteads in. Web individuals. How To File Property Tax Exemption In Texas.

From cedarparktxliving.com

Texas Homestead Tax Exemption Cedar Park Texas Living How To File Property Tax Exemption In Texas Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. How much land can you homestead in texas? Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Here, learn how to claim a homestead. Web what is. How To File Property Tax Exemption In Texas.

From www.signnow.com

Tax Exempt Texas 19912024 Form Fill Out and Sign Printable PDF How To File Property Tax Exemption In Texas Web what is homestead cap? Web filing a texas property tax over 65 exemption has no downsides or extra costs, and it’s a recommended strategy for every. Claim homestead exemption retroactively for the. Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Web file your homestead exemption forms online for free.. How To File Property Tax Exemption In Texas.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format How To File Property Tax Exemption In Texas Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Claim homestead exemption retroactively for the. Web file your homestead exemption forms online for free. Web homestead exemptions can help lower the property taxes on your home. Web all real and tangible personal property in texas is taxable in proportion to its. How To File Property Tax Exemption In Texas.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide How To File Property Tax Exemption In Texas Web individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption. Here, learn how to claim a homestead. Claim homestead exemption retroactively for the. Web what is homestead cap? Web a homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with. Can a married couple. How To File Property Tax Exemption In Texas.